When water damage strikes, many homeowners assume their insurance policy will cover the loss. Unfortunately, that isn’t always the case. Insurance companies frequently deny water damage claims, often leaving families with unexpected repair bills and stressful disputes. Understanding why these denials happen can help you avoid pitfalls and strengthen your position if you ever need to file a claim.

Common Reasons Insurance Denies Water Damage Claims

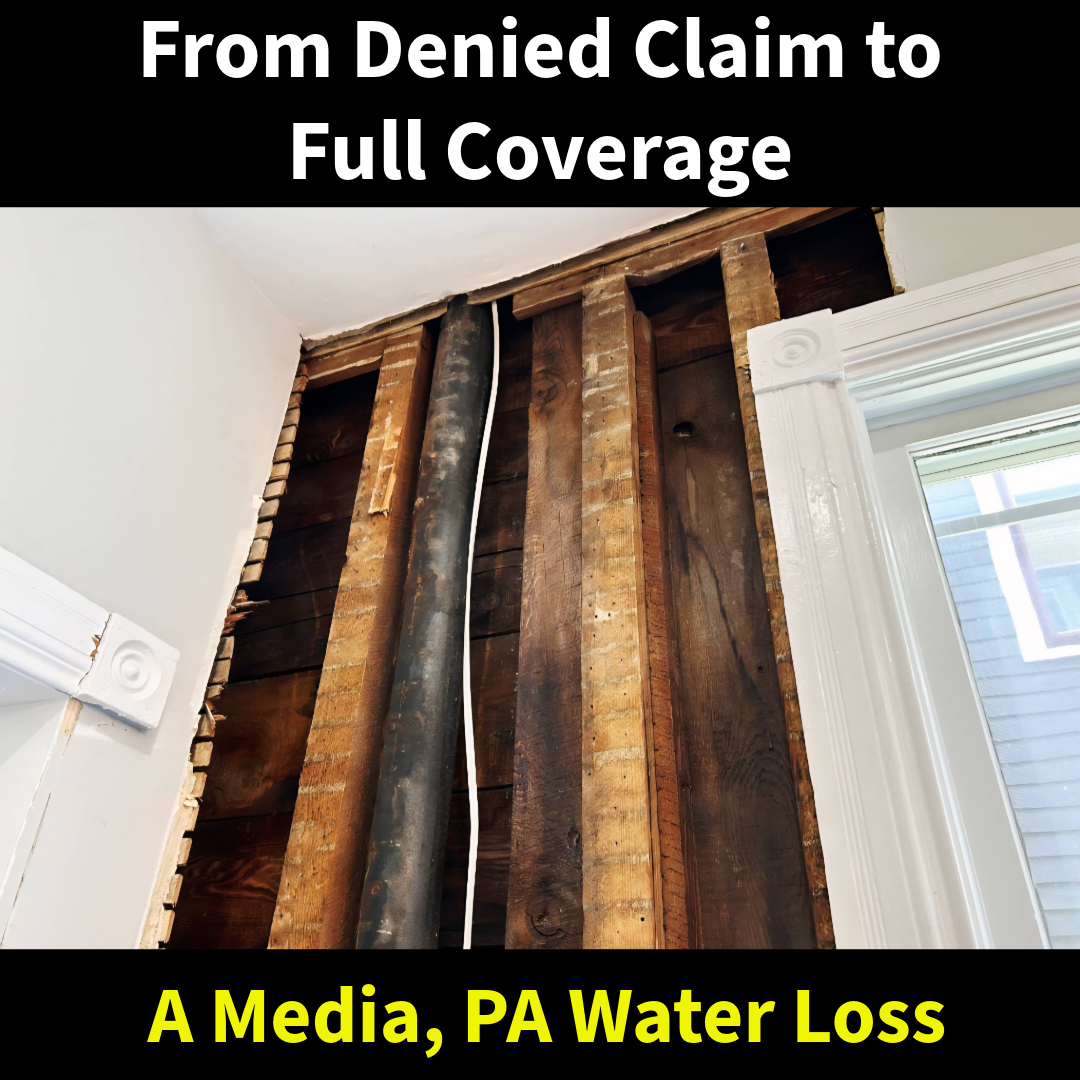

1. “Long-Term” or “Gradual” Leaks

Most standard homeowners’ policies only cover sudden and accidental water damage. If an adjuster determines the loss was caused by a slow leak—such as a dripping pipe behind a wall over months or years—they may call it a “maintenance issue” and deny coverage.

2. Lack of Documentation

If you can’t prove when the damage happened or how it occurred, insurers may claim there’s not enough evidence to tie it to a covered event. Photos, videos, and professional inspection reports are critical in supporting your claim.

3. Excluded Sources of Water

Not all types of water damage are treated equally. For example, many policies exclude flood damage, water backing up through drains, or sewer/septic overflows unless you purchased separate coverage.

4. Mold Resulting from Water Damage

Even when water damage itself is covered, mold growth caused by that damage is often excluded—or capped at very low limits. This leaves homeowners responsible for expensive remediation. Insurance companies frequently argue that “mold takes a long time to grow,” labeling it as long-term damage. In reality, mold can begin germinating in as little as 24 to 48 hours after water intrusion, making this a common but misleading excuse for denial.

How to Protect Yourself Before and After a Loss

- Know Your Policy: Take the time to read your coverage details, especially exclusions related to water damage, mold, sewer backups, and floods.

- Act Quickly: The longer you wait to report or address water damage, the more likely your insurer will call it “long-term.” Contact a restoration professional immediately.

- Document Everything: Photograph the damage from multiple angles, keep damaged materials, and request a professional inspection. Independent reports can make all the difference in disputes.

- Request Clarification in Writing: If your claim is denied, ask for the specific policy language being used against you. This can give you leverage if you need to appeal.

- Use Your Right to Choose a Contractor: Insurance companies may recommend preferred vendors, but you are legally allowed to hire the restoration company of your choice. Choosing a qualified, experienced team ensures the work is done right—not rushed to save the insurer money.

Final Thoughts

Water damage is stressful enough without fighting your insurance company. By understanding the most common reasons for claim denials and taking proactive steps to document and protect your property, you can strengthen your case and improve your chances of a successful payout.

If you’ve experienced water damage and want expert help not just with cleanup, but also with the documentation insurers demand, MSI is here to guide you through every step.